Monday, October 13, 2008

Saturday, October 11, 2008

Friday, September 19, 2008

Friday, September 12, 2008

The Snowball Effect as a Positive Feedback Loop

Subject: RE: The Snowball Effect

From: sbakshi@mdi.ac.in

Date: Fri, September 12, 2008 6:17 am

To: "Ajay Singh Bhati"

Dear Ajay,

In my view, its not correct to always view positive feedback loops in business as destructive, though they well might be. For example a run on a bank can bring it down on its knees in a very short time period and it can spread (systemic risk) to other banks. Similarly stock market bubbles can be thought of positive feedback loops - high prices feed optimism which feeds high prices - it does not last for ever, but it can last for a long long time.

I think you're on the right track when you visualize a positive feedback loop as a mechanism which is nested inside a negative feedback loop. To illustrate, why do bear markets follow bull markets? Because over the long run, markets operate inside a negative feedback loop with built-in corrective mechanisms. When prices run too far away from underlying values, there are forces that pull them back. For example, when stocks become too cheap in relation to the replacement cost of the underlying assets, there is no incentive to create new capacity and industry consolidation is likely to take place wherein the strong players in an industry, instead of creating new capacity, buy out competitors.

Conversely, when stock prices rise so high that they become much more than the replacement cost of the underlying assets, strong incentives are created by those high prices, to create fresh capacity. So shortages follow gluts follow shortages.... - hence a negative feedback loop.

But what caused the speculative bubble in the first place? Why do people suddenly become euphoric about an industry or a sector and invest in it in unison? That part of the answer is better explained by positive feedback loops.

Its also important to view positive feedback loops as means of explaining some of the extreme business successes. I gave two examples in class of the dominant newspaper, and Wal-Mart. But one can think of others. For example, in some industries, the first mover has a big advantage. He goes and captures a very large part of the market and obtains scale economics. And once he's done that, it becomes very difficult to dislodge him. Airtel is one example which comes to mind. There are, I am sure, several other examples...

Rgds

||

==SB

Sir,

Can it assumed that snowball effects (positive feedback) constitute a small alternate parts of negative feedback loop? (Since in a negative feedback loop, balancing acts take place after increase in one of the aspects -- may be a result of snowball effect -- of the process. Also snowball effect generally ends with destruction resulting in the onset of the reverse process.)

Regards,

Ajay Singh Bhati

-----Original Message-----

From: sbakshi@mdi.ac.in [mailto:sbakshi@mdi.ac.in]

Sent: Wednesday, September 10, 2008 7:34 AM

To: bfbv@mdi.ac.in

Subject: The Snowball Effect

Shareholder: You've acknowledged that it's a more difficult investment and business environment today than it was when you first started out. If you were starting out again today in your early thirties, what would you do differently or the same in today's environment to replicate your success? In short, how can I make $30 billion?

Buffett: Start young. As Charlie's always said, the big thing about it is we started building this little snowball on top of a very long hill. We started at a very early age in rolling the snowball down. And of course, the nature of compound interest is that it behaves like a snowball in sticky snow. The trick is to have a very long hill - which means either starting very young or living to be very old.

If I were doing it in the investment world, I would do it exactly the same way. If I were getting out of school today and I had $10,000 to invest, I'd start with the A's.. (The companies whose names begin with the letter "A") And I probably would focus on smaller companies - because I'd be working with smaller sums and there would be a greater chance that something would be overlooked in that arena.

Buffett: As Charlie said earlier it won't be like doing that in 1951 when you could leaf through and find all kinds of things that just leapt off the page at you. But that's the only way to do it. You have to buy businesses - or little pieces of businesses called stocks. You have to buy 'em at attractive prices. And you have to buy into good businesses. That advice will be the same 100 years from now. That's what investing is all about.

And you can't expect anybody else to do it for you. People will not tell you about wonderful, little investments. It's not the way the investment business is set up.

Buffett: When I first visited GEICO back in January of 1951, I went back to Columbia the rest of that year; but I subsequently went down to Blythe & Company, and actually to one other firm . that was a leading analyst of insurance. I thought I'd discovered this wonderful thing - so I'd see what these great investment houses that specialized in insurance stocks said. And they said I didn't know what I was talking about. It wasn't of any interest to them.

You've got to follow your own ideas - with the caveat that you've got to learn what you know and what you don't know. And within the arena of what you know, you have to pursue it very vigorously and act on it when you find it. You can't look around for people to agree with you. You can't look around for people to even know what you're talking about. You have to think for yourself. If you do, you'll find things. Charlie?

Munger: The hard part of the process for most people is the first $100,000. If you have a standing start at zero. Getting together $100,000 is a long struggle for most people. I'd argue that the people who get there relatively quickly are helped if they're passionate about being rational, very eager and opportunistic, and steadily under spend their income grossly. I think those three factors are very helpful.

Wednesday, September 10, 2008

Behavioral Finance & Business Valuation

http://tinyurl.com/5ttus5

Thanks!

Wednesday, June 11, 2008

Seven Documentaries To Watch

Friday, May 16, 2008

SEBI Eliminates Gimmickry in Buybacks

"Why did the company give a maximum price of Rs 750 per share for its buyback, even though the current market price is Rs 280 per share? Indeed, adjusted for stock splits and bonus issues, this company has not seen its stock price hit Rs 750 in the last seven years."

Fast forward to today when Mastek published an important notice in The Financial Express (page 11, New Delhi edition dated may 16, 2008). The company disclosed that SEBI has directed it to:

Good work SEBI.

Wednesday, May 07, 2008

Bongy's Mating Dance with IOC

On November 29, 2006, Bongy announced her intention to get married to IOC. As per the terms of the marriage, the stockholders of Bongy were to get 4 shares of IOC for every 37 shares they were holding on the record date. They are still waiting for the marriage to take place...

Marriage is a very serious business in India. There is lots of planning to do, arrangements to make. And so, since that date in November of 2006, Bongy is still waiting to mate with IOC because her parents, and those of IOC, have yet to give their assent. Interestingly, both Bongy and IOC have the same parents, so I guess, this is going to be an incestuous marriage, which is even more complicated than an Indian arranged marriage:-)

A long engagement period has made Bongy quite restless, as you can see from the chart below (click on it to get a better view):

Since 37 shares of Bongy are to be exchanged with 4 shares of IOC, Bongy should sell for 4/37th or 10.81% of IOC. The red line in the chart above depicts this steadfast relationship.

The red line is the marital bed from which Bongy must not wander too far away.

But its hard to keep Bongy waiting for her groom. She likes to wander away from the marital bed to return only occasionally. The blue line in the chart depicts Bongy's behavior since she got engaged- since then, her life has been volatile, and eventful.

Bongy's mischievous behavior presents opportunities to opportunists like me - arbitrageurs who bet on the outcome of marital events.

For instance, in early March of 2007, when Bongy was found to be somewhere under the marital bed, and not on it, people like me could either think of this as an opportunity to buy OIL cheaply thru Bongy, or we could simply buy Bongy and short IOC in the hope that Bongy will ultimately return to her marital bed, at which time, happy with the outcome, we would reverse our trades.

Then, sometime in June of 2007, Bongy decided to rise above the marital bed (see chart above), and she rose, and rose. Now why would Bongy do something like that? Could she justify her behavior? I asked her and she told me she can explain anything.

She said take a look at my assets, my productive capacity, my ability to generate cash, and compare them with my market value. She said, on a stand-alone basis, that is, if I call off this marriage, I am worth a lot more than the measly 10.81% of IOC. I checked this out, I compared her with other similar girls like Chennai Petro (MRL@IN), and I could not agree more with Bongy. She could indeed explain everything.

But a marriage is a contract we Indians take very seriously. Once Bongy had agreed to merge into IOC, it was not going to be easy for her to walk away. At least that's what some arbitrageurs must have bet, when in November 2007, they could effectively go long IOC at 534, and simultaneously go short Bongy at 98. This trade would have enabled a shrewd arbitrageur, to create Bongy shares thru IOC at a cost of Rs 57 and immediately sell them in the futures market at 98. Of course, this smart arbitrageur (not me) would have to carry forward his positions until March 24, 2o08 because on that date Bongy closed at 46.55 and IOC closed at 432.80. Bongy was now close to 10.81% of IOC, where she belonged. Grudgingly, she had returned to her marital bed. The arb could now reverse his trades and derive pleasure not only from his profits, but also from his successful enforcement of Indian traditions.

But Bongy is hardly traditional. Soon after her momentary visit to the marital bed, she decided to move away again (see chart). She now trades at 13.3% of IOC instead of 10.81%.

How long will it be before she returns to where she belongs?

Indian Overseas Bank Tries its Hand in The Alchemy of Finance

The paper reports that the Bank plans to "sell" some of its real estate to a "special purpose vehicle (SPV)."

There is no mention of the SPV paying cash to the Bank for the acquisition of the real estate assets.

"The world of finance hails the invention of wheel over and over again, often in a slightly more unstable version. All financial innovation involves, in one form or another, the creation of debt, secured in greater or lesser adequacy by real assets."

Tuesday, May 06, 2008

How Weak is this Oily Chain?

The following passage caught my eye:

"Success in the exploration and production of oil & gas requires a company to overcome three interlocking sets of probabilities. The probability that a given geologic structure contains hydrocarbons [let's call this Event A]; the probability that hydrocarbons will be located [lets call this Event B], and the probability that once located, the find can be commercially exploited [let's call this Event C]."

Vikram's statement has vast practical implications for security analysts.

The market value of an asset is the present value of its expected future cash flows. Cash flows from an oil exploration company can be derived only out of hydrocarbons which can be commercially exploited. And for that to happen ALL of the above three events must happen.

Suppose that the probability of Event A happening is 40%, that of Event B happening is 20%, and that of Event C happening is 25%.

Then the probability of seeing cash flow which is valuable is 0.40 x 0.20 x 0.25 or 0.02. That comes to just 2%!

I wonder if the market participants think in those terms before valuing oil exploration stocks.

The man who said that "a chain is only as strong as its weakest link" was wrong.

He should have said "a chain has to be weaker than its weakest link."

Monday, April 21, 2008

Mary Mary, Not Quite Contrary!

Google had just announced that its video web site, YouTube, would soon begin displaying video ads. In her report, Mary initially projected that YouTube’s video ads would result in incremental revenues of $720 million next year. But, while doing the number crunching for her report, Mary made a serious mistake. She took the price of the ads as “$20 CPM” to mean price per ad impression, and not per thousand ad impressions, which is what “CPM” means. In other words, she overstated projected revenues by a factor of 1,000. The actual projected incremental revenues, based on Mary’s corrected model were only $720,000, an insignificant number when compared with Google’s total revenues.

What’s interesting for us, however, is to observe what happened next. When Henry Blodget, another famous internet stock analyst, pointed out Mary’s mistake, on a public forum, she acknowledged her error.

However, instead of revising her overoptimistic conclusions, Mary left them intact! She rationalized them by revising yet another assumption in her model which resulted in much higher projected revenues for Google than would have been the case, had she not made this second revision, In her report update, Mary wrote: “In fixing the error, we also took the opportunity to dig deeper into our assumptions and.... we provide an updated scenario analysis of the opportunity.”

Mary Meeker’s response was not quite contrary to what most of us do, when we are presented with evidence which proves that our previous conclusions may be wrong. When we face such situations, our first reaction, almost always, is to discredit the new piece of evidence which proves us wrong. If we can’t do that, for example when the evidence is solid, we tend to invent other, new reasons, which would keep our prior conclusions intact.

Consider how a chain smoker, who smokes two packs of cigarettes a day behaves when he is first informed by his doctor that smoking causes lung cancer.

His first reaction is that of extreme discomfort arising out of two inconsistent pieces of information - that he smokes and that he was just informed by his doctor that smoking causes lung cancer. The chain-smoker, could, of course, eliminate the feeling of discomfort by quitting smoking immediately, but we know that is not going to be easy at all. Even the great Mark Twain, tried to give up smoking, and after having failed, once remarked, “Its not difficult to quit smoking, I’ve done it hundreds of times!”

One option before our chain smoking friend is to first discredit the medical evidence linking smoking and lung cancer. He could do that by questioning the validity of the medical research behind that finding, or, perhaps, by citing a silly the fact that he once knew a chain-smoking man who lived to a hundred years. Or, he will find other reasons for convincing himself that smoking isn’t really harmful, or that it helps him relax, prevents him from gaining weight etc.

The above example shows that we are capable of going to extremes in order to fool ourselves into believing that we’re right about things about which we are really wrong.

Contrary to the belief of most economic theorists, we’re really not rational animals. Rather, we are rationalizing ones. There are obvious lessons here for the readers.

Take the idea behind what is called as the “sunk-cost fallacy.” We’re obsessed with what it cost us to buy an investment. The cost of our investment is not just a financial commitment made by us - its also an emotional decision about ourselves. We like to think we were right. If the price of a stock moves up after we buy it, we take it as evidence of our intelligence and investing skills.

However, if it falls well below our cost, we tend to overlook negative developments about the company which we learn about subsequent to our purchase - or we tend to under-weigh such information, for example, by deluding ourselves into believing that the adversity our company is facing is only of a short term nature, and that its only a matter of time when our stock will soar.

We consciously ignore other alternative investment opportunities that become available to us, because we don’t want to buy them from cash realized from the sale of a dud investment. We fear that if we sell, we will suffer a loss, not realizing that the loss happened the day we made the wrong decision. We forget a fundamentally sound economic principle that, with a few exceptions, sunk costs i.e. what it cost us to buy a stock, are irrelevant in the sell decision.

Here’s an experiment I would recommend to all of you. Take a look at your portfolio without considering what it cost you to buy those investments. All you have is the name of each stock, the number of shares you own, the current stock price of each investment, and its current market value. Total up the last column to estimate the liquidation value of your portfolio. Notice, you’ve no idea about the cost of the individual investment, or of the entire portfolio.

Now, as objectively as you possibly can, ask yourself this question: “If I did not own all these stocks, but instead had the cash equal to their current market value, then would I buy them today?” Ask this question about every stock that is present in your portfolio. Sometimes the answer will be overwhelmingly “yes”. But when the answer is overwhelmingly “no”, you’ve to ask yourself as to why is the stock in your portfolio in the first place!

The reason why this experiment is useful is because it forces you to forget about the cost. It also forces you to start from a clean slate. When you start from a clean slate, your old past decisions will often appear to be silly, especially when they are compared with other, better alternatives. When you leave the baggage of past decisions behind, and start from a clean slate, you tend to become more rational.

The “sunk cost fallacy” is often reinforced by what is called as the “endowment effect” which shows that once you own something, you value it higher than before you owned it even though there is no rational reason for it.

Somehow, in our minds, our ownership of something wrongly increases its value. For example, just after placing bets, bettors at the racetrack become much more confident about their horse’s chance of winning the race. And lottery ticket buyers tend to buy more frequently if they are allowed to choose their own lottery tickets than when they are not. They also value their lottery tickets more highly if they personally chose them.

In a fascinating experiment, two groups of people were sold lottery tickets with identical chance of winning. Members of one group were allowed to choose their own tickets, while members of the other group were given randomly selected tickets. Immediately after the sale of tickets, but well before the results of the lottery were to be announced, members of both groups were individually asked to quote a price at which they would be willing to sell their tickets. The average quoted price for first group - those who were allowed to select their own tickets - was four times the average quoted price of the second group! Clearly, the act of buying the lottery tickets, when combined with the act of choosing the tickets themselves, magically increased their value to the first group.

There are vast practical implications of these simple experiments for you, dear reader. For you’re going to make mistakes. It’s inevitable that you will make mistakes in your buying decisions. You will face tremendous pressures that will tempt you rationalize your mistakes and not correct them. Your will tend to protect the status quo by inventing new reasons to hold on to a dud investment. This will be especially true when your original buying decision is known to many other people who are important to you. For it will hurt you to acknowledge to them, and to yourself, that you made a mistake, and it will be difficult for you to correct it because, ironically, you will attach more importance to saving face by appearing to be consistent with your past commitments, than trying to become a rational investor.

Contrary to what we may choose to believe, the functional equivalent of Mary Meeker is there in all of us.

Note:

The above piece was published in Outlook Profit, a new fortnightly magazine published by the Outlook group. Reproduced with permission.

Thursday, April 03, 2008

Prof. Bruce Greenwald's Talk on Value Investing

The talk, titled, "Value Investing Frameworks and Business Analytics" was delivered by Prof. Greenwald to an audience of 220 guests from the Indian investment community at Hotel Taj President in Mumbai.

Enrin Bellissimo, Director, Heilbrunn Center for Graham & Dodd Investing, and her colleague, Indira Almadi, gave us their enormous co-operation in organizing this function. Many thanks to both! Many of my ex-students helped me as well - I thank all of you.

Its interesting to know that Prof. Greenwald said that the Indian markets were over valued and due for a correction on the very day the market hit its all time high. On 8 Jan, Nifty closed at 6,287.85 points. As of the date of this writing, Nifty sands at 4,754.20. Thats a decline of 24%.

Since Prof. Greewald's talk, Nifty Midcap 50 Index has declined by 39%.

Over the same period, Nifty's P/E has fallen from 28 to 21 and Nifty Midcap 50's P/E has fallen from 24 to 14.

Prof Greenwald's presentation can be seen from here. (Uploaded with permission).

Here are a few photographs covering the function:

Tuesday, April 01, 2008

Fooled by a Percentage Into Catching Falling Knife!

“Suppose that you visit a furniture store in a mall to buy a lamp for your bedroom. You find a lamp you like and it has a list price of Rs. 5,000. Happy with this deal, when you approach the sales representative ready to buy the lamp you picked, she informs you that one of their stores which is just a ten-minute walk from there is closing down and you can buy the same lamp over there for Rs 1,000 less. Please raise your hand if the 20% discount is sufficient incentive for you to walk ten minutes to the other store to buy your lamp.”

About 70% of the students raise their hands.

My next question is then addressed to only those who raised their hands. I ask them:

“Suppose that you visit a car showroom to buy a car and after checking out many models, you find one you like. It costs Rs. 500,000, you are told by the sales representative. However, she also informs you that one of their showrooms which was just a ten-minute walk from there is closing down and you can buy the same car over there for Rs. 499,000 or Rs. 1,000 less. How many of you would like to walk ten minutes to go over to the other showroom to save Rs. 1,000?”

I hardly see a hand raised.

Somehow, students who were happy to walk ten minutes to save Rs 1,000 on a lamp are reluctant to walk ten minutes to save Rs. 1,000 on a car!

What is going on here?

Indeed, when I reframe both questions again, in a different form, students appeared puzzled:

“Would you walk ten minutes to increase your net worth by Rs. 1,000?”

Why would a man decline to save Rs 1,000 in one situation, and gladly accept it in another, with the same effort required in both situations?

Isn’t a penny saved a penny earned,?

To most people, apparently not, suggests research in behavioral economics. Part of the reason is a bias arising out of a phenomenon called the “contrast effect” which deals with how we treat multiple pieces of information presented to us one after the other.

If you put something sweet in your mouth immediately after tasting a lemon, it will taste much sweeter than it really is. The contrast between sweet and sour gets accentuated if one experiences one taste immediately after the other.

If you meet someone very attractive at a party, and immediately after that you are introduced to someone who, in contrast, is merely average looking, then the average person would appear to be more unattractive to you than would have been the case had you not met the very attractive person beforehand.

Similarly, a saving of Rs. 1,000 looks much bigger than it really is when it is contrasted with a purchase price of Rs 5,000 for a lamp, (a 20 percent saving!) but looks much smaller than it really is when it is contrasted with a purchase price of Rs 500,000 for a car (only 0.2 percent saving).

It does not matter to a man that a Rs 1,000 saving will have the same effect on his net worth whether he saves it on a lamp or a car. Somehow the presence of a 20 percent reduction triggers an irrational response in his brain.

The brain, operating at the subconscious level, is often influenced by the presence of false “anchors”. Anchors are pieces of information to which a mind tends to latch on to while making a decision. And the human mind will often latch on to false anchors created by various influences like availability or contrast.

In a classic experiment, researchers asked a group of people if the Mississippi River in the US is longer or shorter than 500 miles (the anchor). Most people responded that it was longer than 500 miles. They were then asked to estimate the length of that river. The average answer was about 1,000 miles.

A second group, in contrast, was asked if the Mississippi River is longer or shorter than 5,000 miles and were then asked to estimate its length. Most people responded that it was shorter than 5,000 miles but the average length of the River in this group was about 2,000 miles!

The actual length of the Mississippi River is 2,348 miles but false anchors of 500 miles or 5,000 miles tend to pull the average answers towards them!

In the lamp vs. car experiment, students who chose to walk ten minutes to save Rs 1,000 while buying a lamp but who refused to walk ten minutes to save the same amount of money while buying a car, were suffering from “anchoring bias”. Their minds were latching on to the wrong anchor of a large percentage savings on a list price, instead of latching on to the right anchor of their personal net worth.

Anchors are important, of course, but one has to be careful when deciding if an anchor is valid or not. A man who feels miserable because he dropped Rs. 500 from his pocket which had only Rs. 1,000 in it even though his personal net worth is Rs. fifty lacs is suffering from an anchoring bias. He incorrectly identifies the money in his pocket as a valid anchor as opposed to his net worth. He is also suffering from bias arising out of contrast effect because Rs 500 lost out of Rs 1,000 in his pocket looks very big to him in percentage terms.

In contrast, a rational investor who practices wide diversification, knows that its inevitable that some of his picks will turn out to be duds. He does, not, however, let such outcomes make him miserable because he has trained himself to latch on to the right anchors such as the size of his portfolio, and not the percentage lost in a single position.

A stock may have fallen 50 percent from its all-time peak in a market crash, may have gone below its 52-week low price, may have fallen below the price at which its shares were offered in a hot IPO, or may have fallen below par value. None of these things mean that the stock is cheap. A stock is cheap only if its price has fallen well below than what the company is rationally worth on a per-share basis.

In contrast with underlying value which is the right anchor to latch on to, all time peak prices, 52-week low price, IPO price, and par value are all false anchors. If you blindly buy stocks merely because they have fallen well below some false anchors, thereby allowing contrast effect to make you feel that they are much cheaper than they really might be, then you are functionally equivalent to the man who is trying to catch a falling knife.

And that, you will agree, can hurt.

Sanjay Bakshi is a Visiting Professor at Management Development Institute, Gurgaon. www.sanjaybakshi.net

Note:

The above piece was published in Outlook Profit, a new fortnightly magazine published by the Outlook group. Reproduced with permission.

Friday, December 07, 2007

Re: free cash from ops

Question that has troubled me for some time - should one always take the average of the past few years? Or should any leeway be given for a smaller fast growing company as opposed to a large company not growing by as much?

Tuesday, December 04, 2007

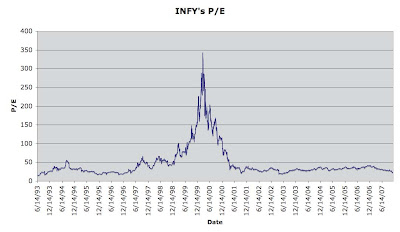

What Should Infy Do to Restore its Honor?

The fellow who bought the stock in March 2000 (the peak of the tech bubble) and held on to the shares in Infosys for more than seven years, essentially did not make any money!

The fellow who bought the stock in March 2000 (the peak of the tech bubble) and held on to the shares in Infosys for more than seven years, essentially did not make any money!One of the most-admired companies in one of the world's fastest growing economies - a company which is debt-free, earns super returns on capital, and is run by a management team which is renowned for its operating skills as well as integrity. And the stock earns nothing in the biggest bull market India has ever seen!

What could explain an outcome like that???

Has the company's earnings declined?

NO! See the chart below:

Infosys's earnings have grown consistently ever since it went public. Moreover, the earnings growth rate has always been well in excess of India's GDP growth rate.

Infosys's earnings have grown consistently ever since it went public. Moreover, the earnings growth rate has always been well in excess of India's GDP growth rate.Now see the chart below - it shows what really happened to Infy.

As the above chart shows, Infy's P/E Multiple chart resembles that of a speculative bubble -and indeed it was a speculative bubble.

As the above chart shows, Infy's P/E Multiple chart resembles that of a speculative bubble -and indeed it was a speculative bubble.At the peak of the tech bubble, the investment (speculative?) community was so optimistic about Infy's prospects, that every rupee of earnings was thought to be worth Rs 350 or so. Today, markets are so pessimistic about Infy that every rupee of its earnings is thought by Mr. Market to be worth no more than Rs 23.

Ben Graham's "Security Analysis" starts with Horace's observation: "Many shall be restored that are now fallen and many shall fall that are now in honor."

What can Infy do to restore its honor, given its current market value, its competitive position, and its financial strength?

What should Infy do?

Monday, December 03, 2007

Quiz: If IFC buys into IFCI, then what?

Sunday, December 02, 2007

The Mystery Behind Mastek's Buyback

- Approval of Board of Directors (which expression shall Include a Committee of Directors of the Company constituted for the purpose) for the purchase of the Company's fully paid up Equity shares each of a face value of Rs 5/- to the extent not exceeding 25% of the Company's paid up Equity Share Capital at a price not exceeding Rs 750 Per equity share from the Open Market through Bombay Stock Exchange Ltd and National Stock Exchange of India Ltd and the total aggregate amount to be expended by the Company for the Buy-back not exceeding Rs 65 crores, i.e. within 25% of the Company's fully paid-up Equity Share Capital and Free Reserves as per audited Balance Sheet as on June 30, 2007, subject to necessary provisions & approvals.

The Board of Directors has appointed Mr. V V Chakradeo, Practicing Company Secretary as the Scrutinizer for conducting the Postal Ballot process in a fair and transparent manner.

The Postal Ballot form duly completed and signed, should reach the scrutinizer not later than the close of working hours on November 26, 2007. The results will be announced on November 27, 2007.

Mr. Buffett's Model of Circle of Competence

Sent: Sunday, December 02, 2007 8:39 AM

To: Ashutosh Datar

Subject: Re: Circle of competence - what is it?

- Mr. Buffett's "circle of competence" has several meanings. One is simply the need to not stray outside an area of one's own skills. The probability of success is much greater if one's does not stray outside one's circle. Mr. Buffett likes to say he has a very large "too tough" basket where most of the things go. But occasionally, he comes across something compelling which he really understands.

- Risk: Mr. Buffett's framework of risk has the circle of competence model at its heart. In his 1993 letter, in which he wrote about his thoughts on risk (defined as probability of permanent capital loss, as opposed to mere quotational losses), he mentioned that risk depends to a large degree on one's ability to accurately predict the future about the situation being examined. He connects the circle of competence model to his idea of risk by relating it to the certainty with which the long-term prospects of the business, the operating skills, the capital-allocation skills, and the integrity of the management can be ascertained by an investor. So, the same investment, may carry different levels of risk for different investors. This, as you know, is contrary to what academic finance teaches. Mr. Buffett, however, believes, that risk comes from not knowing what one is doing.

- I don't think the circle of competence model is industry specific. For example, I consider my own circle of competence in the deep value space and within that space, I have sort of found my calling in the field of special situations. Over the years, I have accumulated a substantial experience in those fields. I think its possible to find deep value in a sector which you do not have to understand to the degree required of a sell-side research analyst.

- My own view is that sell-side analysts often go wrong because they know too much - they have too much information to work with and as a result they often miss the obvious, which can easily, perhaps, be observed by a generalist, who maintains a distance from the noise that surrounds sell-side research. There is a very famous experiment in psychology called the "fire hydrant" experiment. A class of students is divided into two equal groups and each group is separately shown a very blurry image of a fire hydrant which is unrecognizable. Then, the image is brought into focus and the process is stopped at a point well before the image is totally clear to anyone. However, for one group, the image is brought into focus in ten increments, while in the other group its brought into focus in five increments. Note that both groups start with the same image and end with the same image. Surprisingly to many, the group which had more information (ten increments) take much longer to recognize the fire hydrant than the group which had less information. The chief reason is that the members of group which was exposed to more increments come to initial judgments (first conclusions) derived from the pattern-seeking human brain, and then in subsequent information it tend to under-weigh disconfirming evidence and over-weigh confirming evidence of their initial notions (confirmation bias). The second group, on the other hand, does not suffer from these biases. They see no relation between the first image and the next and the next and suddenly they see something that resembles a fire hydrant. The second group - the one with less information - identifies the fire hydrant- much more quickly than the first group which had too much information. The analogy with sell-side research is obvious, in my view.

- Cost of capital - Circle of competence has much to do with cost of capital. The opportunity of cost an investment is the expected return of the next best investment which is available to me. The key phrase is "available to me". Now, most of the things that happen in the stock market and fall outside my circle of competence, are not "available to me" so they must not influence my thinking about opportunity costs. This is fundamentally logical, in my view, and is totally at odds with Markowitz's model of portfolio optimization.

- This means that there will always be some strategy which will be doing far better that what I know and understand. Does that mean that I must run after that strategy? No! So long as my own strategy, derived out of my own circle of competence, has delivered me satisfactory results and is expected to do so in the future as well, I don't have to be envious (envy being the deadliest of the seven deadly sins), I should be contended. This is consistent with the Herb Simon's idea of satisficing as an application of his theory of bounded rationality.

- One's own circle of competence expands over time through personal and vicarious experience - the latter one obtained primarily through careful reading of extreme successes and failures - the lollapalooza outcomes - and relating them to the causal factors (mental models) which combined to produce those outcomes. In this respect, vicarious experience is terribly important, according to Mr. Munger, for "you do not have to to do it to learn not to pee on an electrified." :-)

- You really have to choose a field that you feel passionate about - it could be a sector, it could be a strategy (deep value, special situations, growth, momentum - whatever), it could be top-down or it could be bottoms up - It does not matter. What does matter is that you have real passion for it, and you have determination to build a circle of competence in that space and to expand it over time through the accumulation of experience - both direct and vicarious.

- WB talks about buying businesses that he understands, buying businesses that are simple, what does it mean? I mean Coca-cola is a simple business but Petrochina I guess is a whole lot complicated than that… add the political risk of dealing with ppl as opaque as Chinese and it seems kinda odd to me.

- Is circle of competence necessarily a sector thing? I mean someone could say I can call the interest rate cycle or politics for that matter, so he could use it for a wide range of sectors which are affected by that…

- Lastly, how does one go about developing his/her own circle/niche? Is it just a natural process driven by time?

Tuesday, November 27, 2007

Incentive-caused Bias in the Medical Profession

Mr. Munger likes to talk about incentive-caused bias as a very powerful psychological tendency, which makes, "a decent man, driven both consciously and subconsciously, by incentives, drift into immoral behavior in order to get what he wants."

Monday, November 26, 2007

Quiz for Students on LGB

Subject: Analyze This

From: sbakshi@mdi.ac.in

Date: Mon, November 26, 2007 11:13 pm

To: bfbv@mdi.ac.in

--------------------------------------------------------------------------

How would you analyze this?

Text Follows:

August 7, 2007

LG Balakrishnan & Bros Ltd has informed BSE that the Board of Directors of the Company at its meeting held on July 30, 2007, has intended to reduce the paidup capital of the Company by extinguishing 5,658,000 equity shares of Re 1 each held by Trustees LGB Shareholding Trust allotted to them by virtue of scheme of amalgamation as approved by the High Court of Madras, subject to the approval of the shareholders and the High Court.

And this:

Text Follows:

November 26, 2007

LG Balakrishnan & Bros Ltd has informed BSE regarding the order for confirmation by the High Court of Madras under Section 101 and 102 and other applicable provisions of the Companies Act, 1956, for the reduction of the existing fully paid up Share Capital of the Company from Rs 84,139,034 divided into 84,139,034 Equity Shares of Re 1/- each to Rs

78,481,034 divided into 78,481,034 equity shares of Re 1/- each so as to reflect the true paid up capital of the Company by cancellation of 5,658,000 equity shares of Re 1/- each amounting to Rs 5,658,000 in the Company standing in the name of Sri. B Vijayakumar, Sri. P S Balasubramanian and Sri. S Sivakumar, Trustees of LGB Shareholding Trust, which represents the own capital of the Company.

Quiz for Students: Fraud Analysis

Text follows:

Hexaware Technologies Ltd on November 26, 2007 reported that its Board of Directors has appointed a special committee to conduct an internal investigation and make recommendations for changes to its foreign exchange management practices. This action is due to certain actively concealed and potentially fraudulent foreign exchange Option transactions conducted by one Hexaware official. The Hexaware official, who exercised unauthorised fiduciary powers, has been immediately suspended, pending Investigation. Hexaware plans to provision between US$ 20-25 million to cover any potential exposure as a result of these transactions.

The series of forex transactions in question were initiated over the last few months. These transactions were unauthorised and outside the Company's normal hedging program. The information regarding these transactions was intentionally withheld from the senior management and the Board of Directors and was not included in internal reports. The first transaction came to light on November 22, 2007. Preliminary investigations conducted

over Friday, Saturday and Sunday led to uncovering of more such transactions.

"The need for provisioning is because or direct actions of one individual which were actively concealed," said Rusi Brij, Vice Chairman and CEO.

A meeting of the Board of Directors was called on November 26, 2007, where it was decided to appoint a Special Committee comprising the following independent directors, to conduct a thorough investigation into the transactions:

- Mr. Shailesh Haribhakti, Chairman of the Audit Committee

- Ms. Preeti Mehta, Partner, Kanga & Co.

- Mr. L S, Sarma, Member of Audit Committee

"As immediate steps, an embargo has been placed on all Option deals; future forex deals will necessarily have to be transacted jointly by two signatories out of the designated four from amongst the top management; the Company's authorised dealers are being informed about this procedure and the internal auditors (KPMG) are being asked to conduct a thorough audit of the function. The Company will continue to maintain the normal hedging strategy to protect against the rupee appreciation," said Shailesh Haribhakti, Chairman of the Audit Committee.

The Company will take all measures and actions as advised by the Special Committee of the Board of Directors, Statutory Auditors (Deloitte) and Legal Advisers, to mitigate the impact or the transactions and prevent recurrence of similar situations in the future.

"The Company's business remains robust and its future growth trajectory unaffected. Our order book, as of September 30, 2007, stands at over US$300 million. We will continue to build on that," added Rusi Brij.

Friday, November 02, 2007

Competitive Project on a Deep Value Stock

There is a stock out there which, even in this so-called raging bull

market, is offering a dividend yield in excess of AAA bond yield (remember

Graham loved stocks that yielded more than 2/3rd of AAA bond yield).

The unique thing about this stock is that the company to which it belongs

is essentially debt-free. This combination of debt-free status and a high

dividend yield is very attractive, in my view.

Which stock is it?

The group which identifies it first and sends me a report on it, with not

just the name of the stock, but clear demonstration of its cheapness won't

have to submit a project for this term.

Rgds

==SB

Thursday, November 01, 2007

Class Group Project Competition

---------------------------- Original Message ----------------------------

Subject: Group Project Competition

From: sbakshi@mdi.ac.in

Date: Thu, November 1, 2007 1:18 pm

To: bfbv@mdi.ac.in

--------------------------------------------------------------------------

Ok here is the deal...

There is a special situation opportunity available in the market today

which promises a return of at least 35% p.a.pretax (the max return in my

view is in the range of 50% p.a. pretax) with very low risk of loss.

Moreover, the deal is suited for debt financing, and is also liquid.

Which group can find this opportunity?

Hint 1: The announcement of the transaction which led to the creation of

this special situation opportunity was made on BSE sometime in the last

ten days.

Hint 2: The operation involves buying a security from the stock market and

thats it. You don't have to sell. You don't have to tender.

This is a competitive project competition. All class groups are invited to

compete. However, only the first TWO GROUP PROJECT REPORTS with the

correct answer and reasoning will be considered towards completion of

group project component for term 5.

Rgds

==SB

Thursday, September 20, 2007

Memo to Students: Bob Hamman Video

http://www.scapromotions.com/

"Ajit Jain is the guiding genius of our super-cat business and writes important non-cat business as well. In insurance, the term "catastrophe" is applied to an event, such as a hurricane or earthquake, that causes a great many insured losses. The other deals Ajit enters into usually cover only a single large loss. A simplified description of three transactions from last year will illustrate both what I mean and Ajit's versatility. We insured: (1) The life of Mike Tyson for a sum that is large initially and that, fight-by-fight, gradually declines to zero over the next few years; (2) Lloyd's against more than 225 of its "names" dying during the year; and (3) The launch, and a year of orbit, of two Chinese satellites. Happily, both satellites are orbiting, the Lloyd's folk avoided abnormal mortality, and if Mike Tyson looked any healthier, no one would get in the ring with him."

The Bob Hamman video can be seen by clicking the link titled "Risky Business"

Lectures 03 & 04: Risk Arbitrage, Fermat-Pascal, and Life

- Graham, Buffett, and Rubin suggested as role models for learning risk arb and the fermat/pascal way of probabilistic thinking.

- Case on Arcata Corporation from the Buffett letters was discussed at length to illustrate the idea behind risk arb

- Risk arb defined, Buffett's four questions on risk arb deal analysis (probability of deal going thru, time to consummation, chances of icing on the cake, and worst case scenario)

- Graham's framework on special situations from the appendix of the 3rd edition of Security Analysis, Walter Schloss on that appendix, and how my own career was deeply influenced by it.

- Robert Rubin's philosophy on risk arb (students were asked to do substantial reading on Rubin prior to class), Graham-Newman's arbitrage results over a long time, Buffett's own results in the field.

- Extended discussion of the the GE Shipping spinoff deal, the twists and turns in that deal

- Discussion of some old deals from my experience involving bailouts, mutual fund arbitrage, creating cheap shares in schemes of arrangements, tender offers, buybacks, going-private transactions, merger arb, dividend capture, and recapitalizations.

- Fermat/Pascal system of thinking, the necessity of developing an expected value frame of mind (Fermat/Pascal letters can be seen from here.

- Rubin's four principles of decision-making - the uncertainty principle, probabilistic thinking, decisions and actions being different (includes the ideas of preserving optionality and sometimes having to choose the least worst option), and the importance of process over outcomes.

- Process vs. Outcome- bad process will inevitably produce bad long term outcomes, but bad short-term outcomes do not necessarily imply a bad process, importance of luck in success.

- Frequency-Magnitude framework of expected value, how the world focuses on frequencies and not magnitudes and expected values, the jellybean experiment, how people give up an idea because they think its too tough without thinking thru the consequences of success, how long term-success almost never comes from the first idea, how conviction in oneself and cumulative learning produce good long-term outcomes even though they are improbable (you only have to get rich once), the venture cap model (low chance of success, high magnitude of success in a few cases), how someone can be wrong most of the time, and be right just a few times (Taleb's bleed strategy).

- Preserving optionality - the deep simplicity behind black-scholes - options have value even when they are out-of-the-money because of time and volatility, the more the volatility, the more the value of the option, the importance of not making a decision i.e. deferring it, particularly in a dynamic situation, allowing new information to come in which changes the odds, Graham's idea of never converting a convertible, how risk arb teaches the benefits of keeping options open till the last possible moment ("stuff happens"), we will cross the bridge when we come to it.

- Contrary viewpoint - when to burn bridges, when to close options and make decisions, how often big decisions in life often involve burning bridges, while generally the preserving optionality model is very useful, particularly in investing.

- Probability Blindness, how people make big mistakes when they estimate probabilities, denominator blindness (an example of anchoring bias), the monty hall problem, believing that trends are destiny, wrong perceptions of risk because some bad event has not happened for a long time (people assume its become safe when the exact opposite is true e.g. some earthquake-prone areas which have not experienced an earthquake for a long time), conjunction fallacy, mistakes in interpreting causal chains (a chain cannot be stronger than its weakest link)

- Why is risk arb fun apart from the money? Forces you to think rationally using expected value framework which is dynamic requiring frequent calibration of thinking in response to new information and new interpretation of old information, forces you to think about

opportunity cost, requires multi-disciplinary thinking (e.g. probability, psychology particularly game theory, law particularly corporate and securities law, and finance), and of course the availability of un-co-related to market opportunities arising out of corporate actions, giving the arbitrageur plenty of very interesting things to do... - How the expected value framework, so well-taught by practicing risk arbitrage, can also be be used in regular straight value investing, Buffett's case on investing in Wells Fargo, how he estimated worst case scenario and exploited the perception-reality gap in the

marketplace.